The private banking world has long maintained its business model. However, the growing gap between the profitability of the business models and the size of the market has precipitated a shift towards innovation. The integrated value chain no longer prevails. Wealthtech is making way for the platformization and digitalization of wealth management services. Let’s take a look at the upcoming innovation trends for private banking players.

Digitalization of services, yes, human interaction, always

Instantaneousness, mobility, autonomy: the evolution of customer expectations is forcing private banking to reinvent itself. Financial technology (Fintech) start-ups have jumped into the breach, as they have done in retail banking.

While payments are particularly affected, wealth management is no longer immune. The rise of the WealthTech industry is the best illustration: “Total funding to the sector has more than tripled since 2016, from $2.8 billion to $9.3 billion at the end of 2020, according to figures published by FinTech Global[1] .”

From onboarding to reporting, the digitalization of the customer journey is a tool at the banker’s service. And all over the world, new Fintechs are pushing for the dematerialization of all interactions:

- electronic signature from the online space ;

- biometric authentication elements (facial or voice recognition, fingerprint, etc.);

- push notifications on smartphones as alerts;

- gamification elements to enrich the content and user experience;

- ultra-selective social networks to access quality news. An example is the launch of the “The Leader’s Connection” application by a start-up from the BNP Paribas Wealth Management “Factory” in Luxembourg.

Private bank clients are more autonomous in managing their asset portfolio. However, wealth managers work for a privileged audience, a clientele that values the network and personalized advice. Wealth managers must ensure that human interaction is maintained in their management strategy.

| What do clients expect from private bankers ? Thanks to innovations, the use of digital technology aims to meet the expectations of private bank clients, in order to better support them in their strategy. According to the latest annual investment barometer of the French Family Office[2] Association, wealthy families are focusing on : anticipating risks ;Fears of bankruptcy of certain assets following the pandemic;the fear of missing out on post-covid recovery opportunities. Note that their investments are mainly based on five asset classes. Listed stocks (20%).Private equity (20%).Investment real estate (18%).Precautionary liquid media (12%).Multi-support life insurance (11%). Each company’s technological innovation offering targets these expectations to improve the customer experience around the main asset classes in play. |

AI, big data, blockchain at the heart of innovation in private banking

Technological innovation responds to a twofold problem: facilitating access to information and service, while reducing costs for the private bank.

Some solutions are already in place, such as artificial intelligence, which facilitates the prediction of financial markets or the personalization of recommendations, thanks to increasingly powerful algorithms. Big data processing tools enable the automation of trading operations. They are used in the global framework of asset or company valuation.

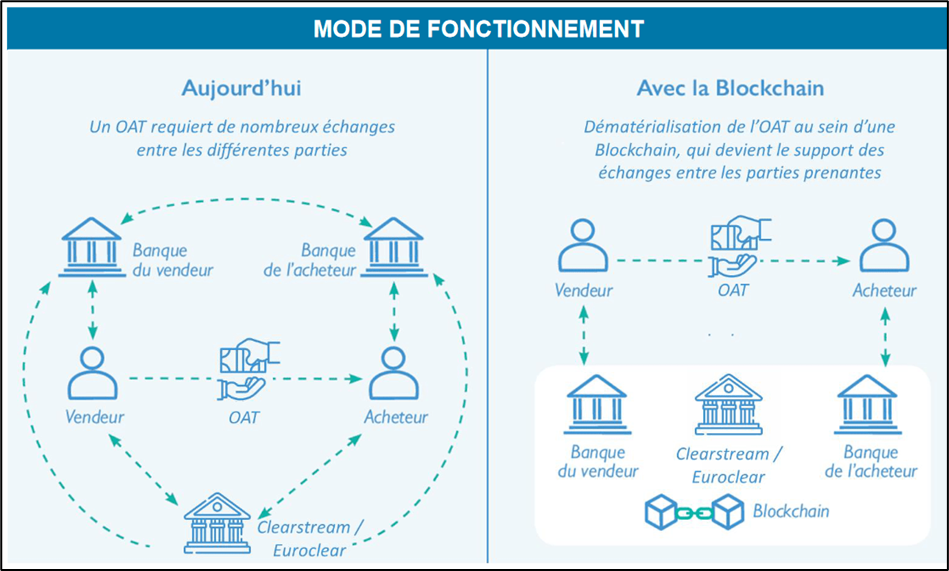

Another innovation in private banking is the work on blockchain. This vast register certifies and records transactions, without being able to be falsified, by means of smart contracts. The blockchain lowers costs and speeds up operations.

The tokenization of assets opens up the fund distribution and securities management chains to a wider audience. Note the reluctance of private bankers for crypto-currencies deemed far too volatile, although several international players have jumped the gun in 2021 (Goldman Sachs, Morgan Stanley, DBS in Singapore, etc.).

New solutions in digital for private banking: how tokenization of assets on blockchain works [3]

Online life insurance: robo-advisors and ETFs in force

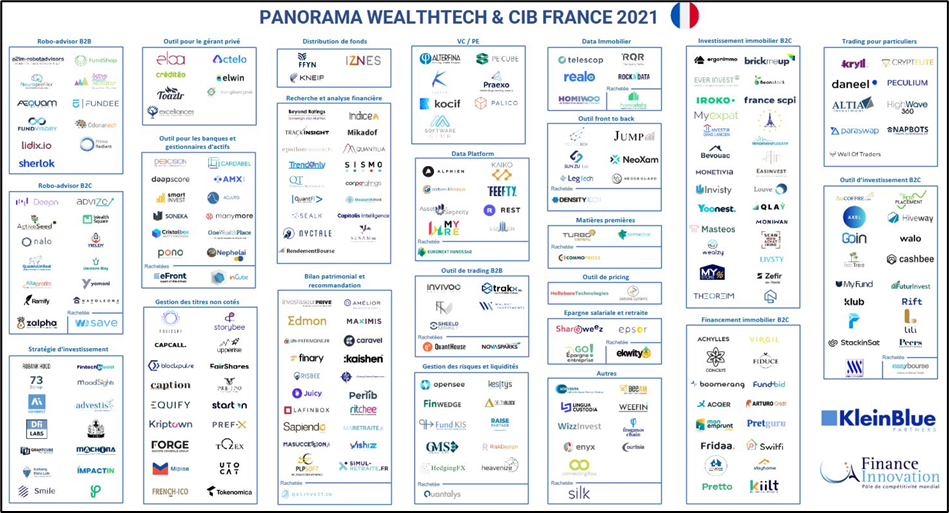

Many Wealthtechs are investing in the field of robo-advisors in France, around the locomotives Yomoni[4] (€500 million in assets under management in September 2021) and Nalo (€250 million in assets under management in 2021, compared to €30 million in 2019). Online life insurance players have taken full advantage of the covid savings accumulated by French households during the health crisis (collection of more than 142 billion euros).

In addition to life insurance, ordinary securities accounts (CTOs) and retirement savings plans (PERs) are also affected by buoyant growth in unit-linked products. They represented 41% of contributions in June 2021, compared with 35% the previous year[5]. This appetite of savers for online life insurance is tempered by the fact that it represents less than 2% of total assets under management in France.

The size of the market is an opportunity for asset management fintechs. They rely on robo-advisors, which pilot investment strategies previously validated by human advice. Investors benefit from lower operating costs, but also from lower management costs thanks to investments in ETFs (exchange traded funds). These financial indexes allow diversification of portfolios and the search for performance, while minimizing risks.

Wealth Tech are financial technology companies, positioned in asset management, including B2B and B2C robo-advisors for online life insurance[6]

Sustainable finance and ESG criteria are omnipresent

While financial education in France still needs to be perfected, private banking players must now take into account the aspirations of better informed investors. The responsible nature of investments is becoming a factor in decisions when it comes to developing a wealth management strategy. Extra-financial criteria such as governance or environmental footprint are now coming into play alongside strict financial criteria.

This is particularly the case among young Millennials, who are very attentive to the orientation of their savings. In fact, ESG assets have tripled in the last two years, a trend that online life insurance companies are integrating into their ETFs through robo-advisors.

However, this trend requires a lot of information, hence the importance of machine learning and Natural Language Processing (NLP) tools. For example, fintechs offer investors and professionals the ability to calculate the carbon impact of their asset portfolio. Others are marketing green ETFs and 100% responsible mandates.

But institutional private banking players are also riding the wave, like Pearl Stratégie of the Edmond de Rothschild Private Equity group. The industrial fund combines sustainable finance and private equity to contribute to the development of environmental infrastructures on a European scale (water resource management, renewable energy production, waste recycling and recovery projects, etc.).

| Responsible finance: what is the difference between ESG and SRI ? ESG criteria correspond to an analysis grid applied by rating agencies to companies, including their environmental, social and governance dimensions. Reading these non-financial criteria is one of the methods used by private asset managers to conduct a socially responsible investment (SRI) strategy. This is known as investing in SRI funds on the markets. |

To conclude, innovation in the private sector takes several directions that eventually converge towards:

- improving the customer experience, from the moment the customer enters the relationship to the follow-up of the investment;

- optimizing costs, both in product innovation and in distribution.

The trend is to pursue partnerships between traditional players and WealthTech around artificial intelligence, robo advisors and data analysis. Blockchain also opens up real prospects for security and reliability of transactions for the private bank, which is attentive but cautious towards decentralized finance (DeFI) and cryptoassets.

Nevertheless, the human advisor will continue to play a leading role in strategic decisions, prioritization of information and consideration of the meaning of investment (sustainable finance, ESG criteria). Without forgetting that the private banker remains the guarantor of a network of relationships dear to the great fortunes, sensitive to exclusive investment opportunities or meetings.

[1] https://fintech.global/wealthtech100/

[2] https://argent.boursier.com/epargne/actualites/les-actions-cotees-restent-le-placement-favori-des-grandes-fortunes-6610.html

[3] http://www.observatoire-metiers-banque.fr/mediaServe/OMB_Blockchain_la_tokenisation_actifs.pdf?ixh=4233741919106105630

[4] https://www.yomoni.fr/ressources/presse/2021-09-13-cp-yomoni-6-ans.pdf

[5] https://www.ffa-assurance.fr/actualites/avec-des-cotisations-de-137-milliards-euros-et-une-collecte-nette-en-unites-de-compte-de

[6] https://finance-innovation.org/wp-content/uploads/2021/09/Linnovation-dans-la-Wealthtech-CIB-en-France-VF.pdf