A fintech innovation dedicated to private banks to reinvent the administrative management of life insurance

A fintech innovation dedicated to private banks to reinvent the administrative management of life insurance

The Hokus Platform’s promise to private bankers was ambitious from the start:

No more wasting 30+ hours on a life insurance subscription

Putting an end to spending 4 hours on each policy arbitration

Finally focusing your resources on your clients

But we delivered on it.

Staying attractive as a private bank is no longer that simple

A competitive wealth management market

Faced with the multiplication of wealth management offers on the market, private banks’ clients are becoming more and more demanding. They particularly expect:

- A wide range of life insurance products;

- From several French and Luxembourg providers;

- With strong large players and innovative small players.

However, for you as a private bank, multiplying life insurance providers is far from easy and involves :

- A heavier resource burden on low-value-added tasks, such as filling out paper forms and sending them by e-mail;

- An increasing risk of errors with each additional manual entry;

- Higher IT costs to add new contracts and maintain existing ones.

Faced with a lack of adapted offers and heavier regulations, is the only solution to restrict one's life insurance portfolio and risk losing appeal for clients?

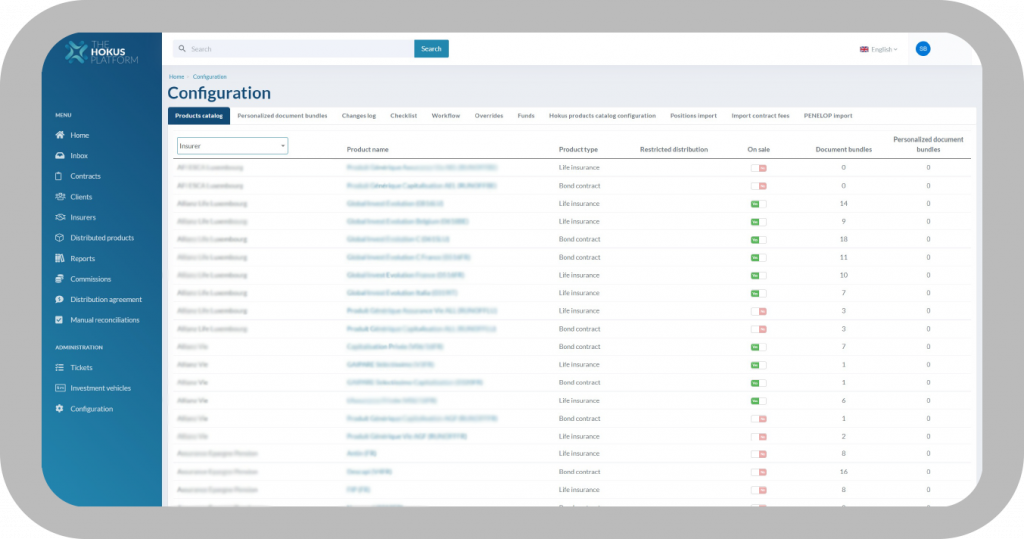

The solution: a unique digital platform to standardize and centralize the management of life insurance contracts

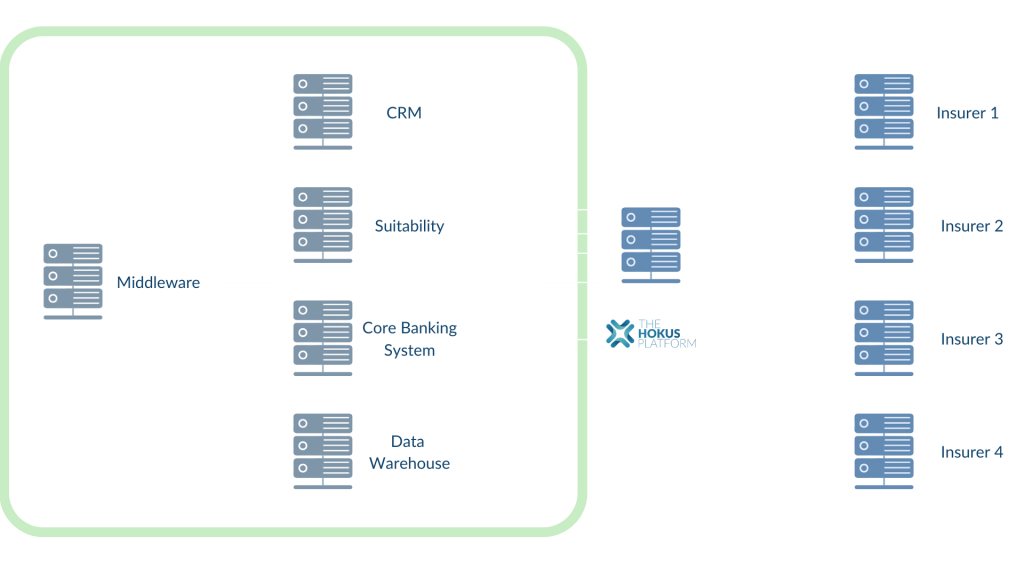

This is what The Hokus Platform offers: a platform accessible in SaaS mode to digitize all of its life insurance administration, allowing to:

- digitize current contracts and new policy subscription processes;

- optimize management of exchanges through a configurable workflow;

- streamline all data in a single standard format.

different insurers

- One digital platform

With The Hokus Platform tool, you can:

Optimize operational efficiency

Reduce costs related to life insurance operations by 60%

Secure your business in strict compliance with regulatory requirements

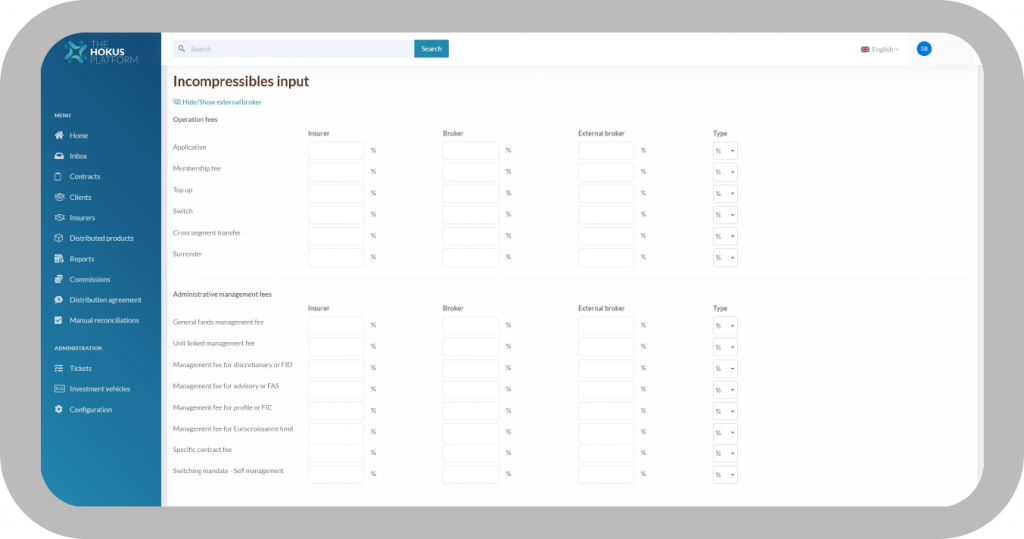

Eliminate additional costs or functional gaps related to the specificities of life insurance

Enhance the user experience for all stakeholders

An innovative, collaborative, interoperable

and secure SaaS platform

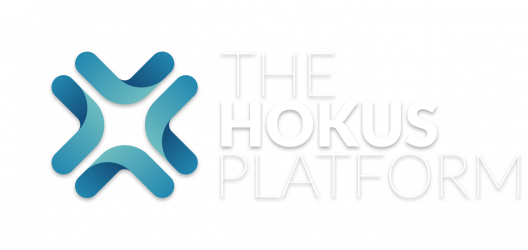

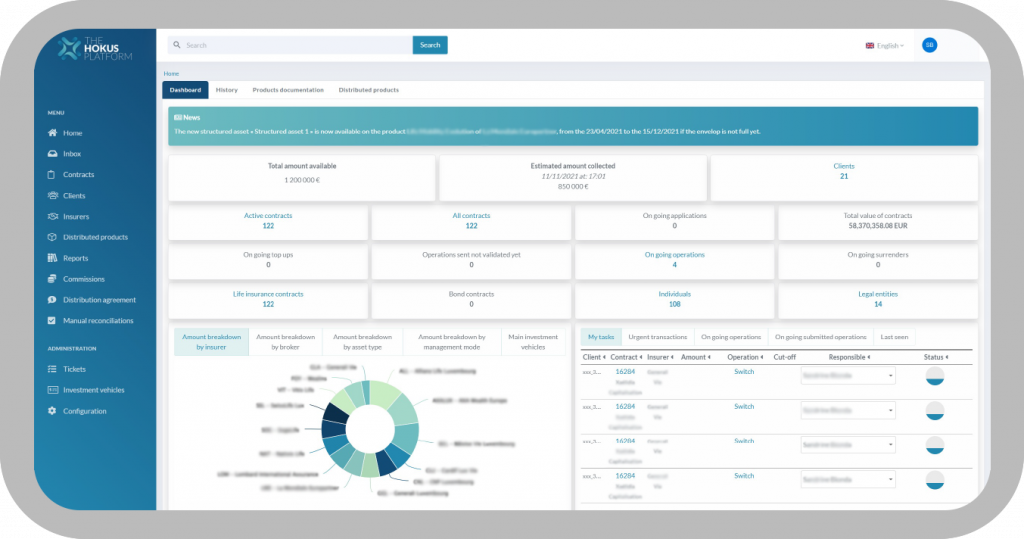

4 modules focused on performance, quality and speed

Our 4 modules

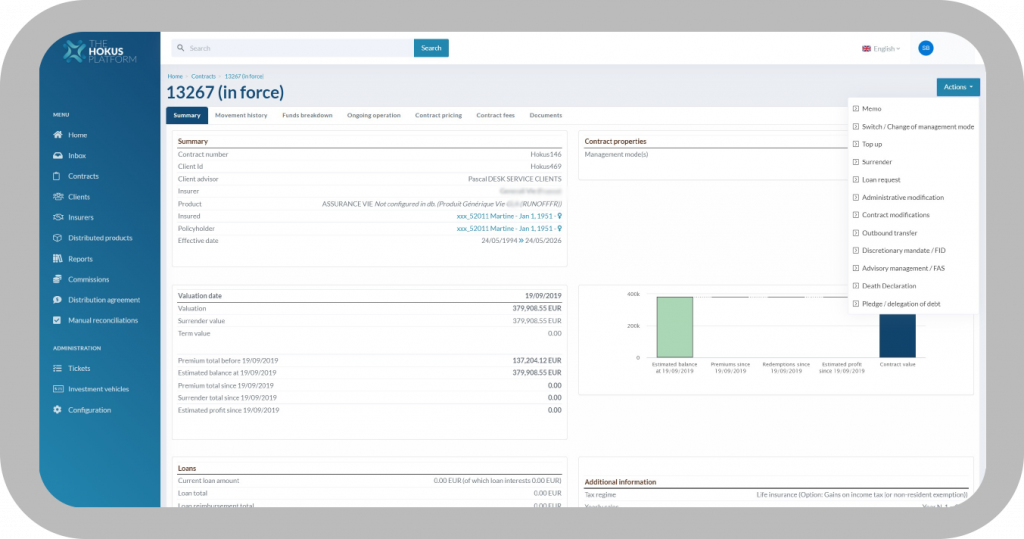

Consultation

Access a consolidated view of all the life insurance assets of the clients within your scope of action

Retrieve easily and in a few clicks :

- the investment reports for clients

- the transaction history and all related documents

- the commission logs

- the transactions’ processing status from insurers

- all the data associated with each contract

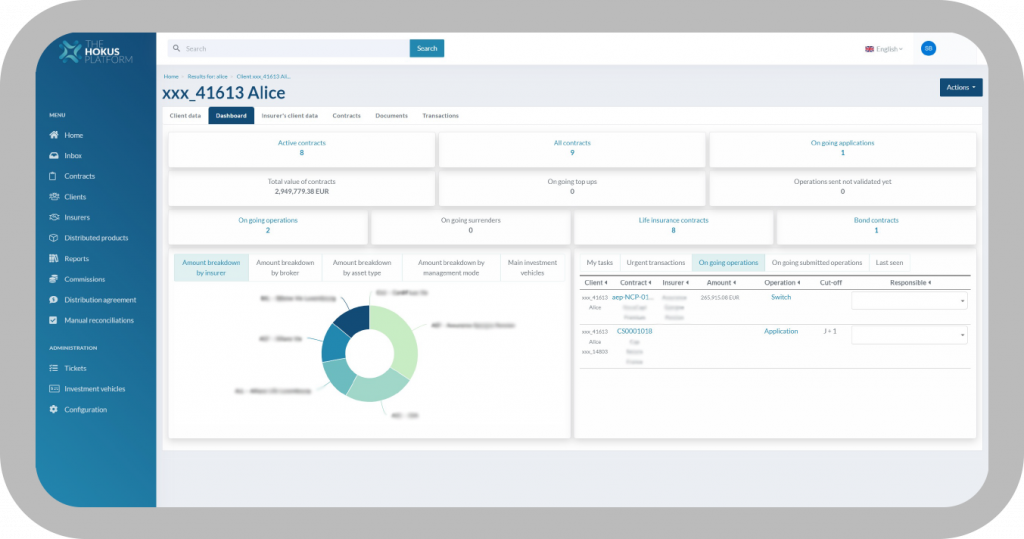

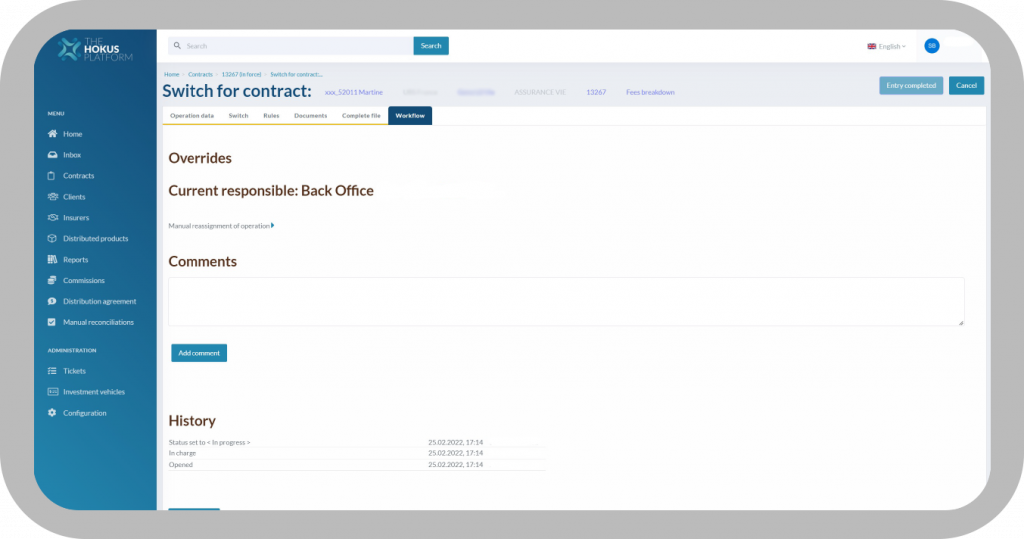

Transactional

Carry out all the management tasks of your portfolio on a single tool from a client and/or a contract dashboard:

- Digitalize operations, including subscription, payment and arbitration

- Sign and submit all your documents to the insurers with ease

- Safely rely and benefit from the enhanced security on all your operations

Une insurtech fondée sur une technologie fiable et évolutive

Our 4 priorities

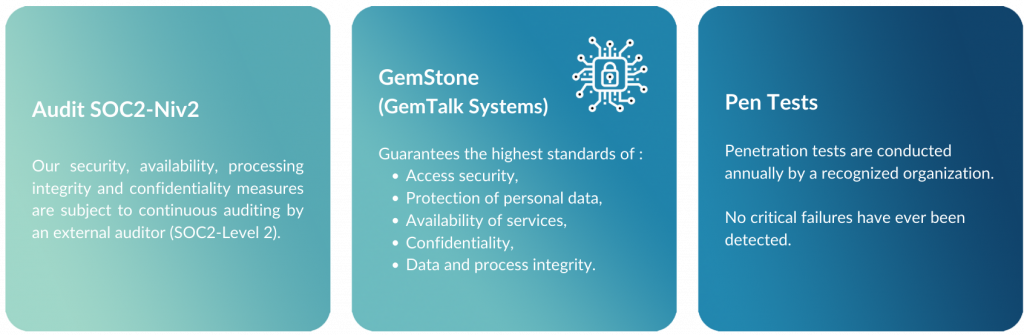

Security

- The life insurance contracts and the various operations that can be carried out on the platform remain compliant with the regulations.

- Our solution is based on high standards of data protection and cyber security with a dedicated Data Protection Officer.

- Our company is certified as “Insurance Sector Professional” (“Professionnel du Secteur de l’Assurance” – PSA). For you, this is an additional peace of mind:

- We guarantee you the observance of professional secrecy

- Our data servers are hosted in Luxembourg

- Access to the platform is secured and conditioned by connection IP

- The solution integrates a control system using multiple certificates

Teamwork

With a fully customizable workflow for your needs, The Hokus Platform simplifies collaboration.

For this purpose, you can set up:

- The management of waiver paths with signatory designation;

- The ability to interact directly with other users/teams;

- Compliance and completeness checks with assigned teams.

Our teams of experts will help you integrate the solution and adapt it to your specific needs

Integrating a multi-insurer digital solution is a complex process

Our teams of specialists and experts are dedicated to supporting you throughout the integration of the product into your existing systems.

Your needs are unique

We are attentive to your needs in order to offer a personalized solution adapted to your requirements, your clients and your life insurance providers.

Discover firsthand our innovative

fintech platform for private banks

Discover firsthand our innovative fintech platform for private banks

These customers have already adopted

our solution The Hokus Platform